Full Recovery in Sight: U.S. Manufacturing Predicted to Regain All Output Lost in the Great Recession by April 2019

Macroeconomic Backdrop for Total Manufacturing and Industry Subsector Forecasts

After years of post-financial crisis struggle, the U.S. manufacturing sector finally has a range of recovery tailwinds that are catalyzing its increasingly sunny outlook. The world is now experiencing a strengthening economic rebound, with every major region enjoying stable performance. Some regions, including the Eurozone, are growing above the expectations of forecasters. The global economic rebound along with the passage of tax reform legislation in the U.S. and the resumption of a much-needed dollar depreciation that began in the early months of 2017 has given rise to the MAPI Foundation’s outlook for the best U.S. manufacturing growth performance in more than a decade.

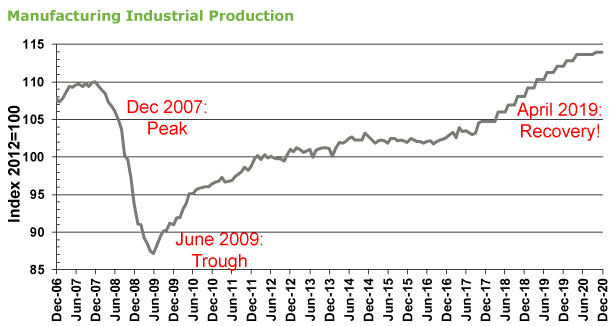

As of the latest data for January 2018, manufacturing output remains 4.7% below the December 2007 level. For the first time, however, recovery is seen in our forecast. We project that the U.S. manufacturing sector will fully regain all lost output by April 2019, just short of a decade since a trough was reached in June 2009.

Sources: Federal Reserve Board and MAPI Foundation

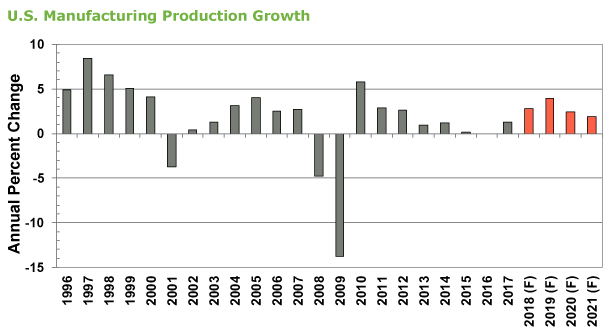

The current forecast represents a measurable jump from our November 2017 outlook. In fact, it is a near doubling of our projection for average U.S. manufacturing growth for the 2018-2021 period, from 1.5% to 2.8%. While seemingly dramatic, this marks the return to a long-term normal for factory sector growth. Such performance has long been impeded by the financial crisis, the Great Recession, and the weak and risk-laden years of global performance that followed.

F = Forecast; Sources: Federal Reserve Board and MAPI Foundation

Turbulence in the financial markets and all that it signals is the most significant risk to this otherwise bright scenario. While the correction in the high-flying stock market was long overdue, the market pullback that began in late January has been volatile enough to add a dose of uncertainty to the overall economic picture. The measurable rise in the yield on the 10-year U.S. Treasury note, currently at the highest level in more than four years, has arguably been the primary catalyst for the market swoon. The rise, catalyzed to some extent by signs that long-dormant inflation might be poised to reappear, has been a signal that eventually, and perhaps quickly, financial conditions may tighten to historical norms. The rise in interest rates and the return of significant equity market volatility creates both uncertainty and concern about the near-term path of monetary policy. Jittery financial markets can motivate a dovish interest rate policy while rising bond yields could force the Fed to play catch up to the markets.

Forecast of Total Manufacturing and Major Manufacturing Subsectors

U.S. manufacturing demand and profitability are accelerating. Catalyzed by meaningful improvement in the outlook for capital spending, and for export growth, the MAPI Foundation currently projects that U.S. manufacturing growth will average 2.8% between 2018 and 2021, nearly double the 1.5% average growth rate that we projected in our November 2017 report.

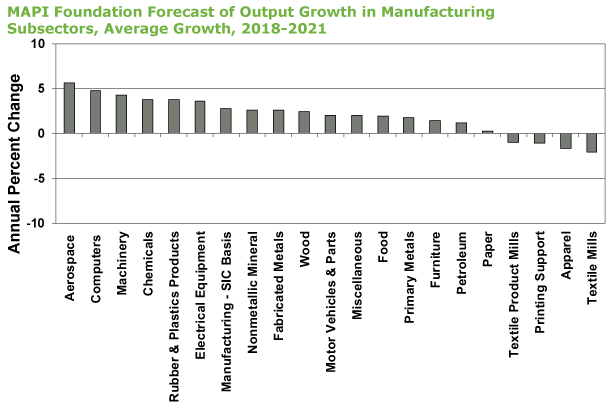

While textile mills and textile product mills retain a bleak outlook, a forecast for positive growth in apparel during 2020 along with the recent rise in apparel prices supports those who argue that a structural change might be coming to these battered subsectors, at least partially due to the benefits of disruptive production technologies. Although faint, these signals are often the beginning of a shift away from a negative trend. At such turning points, deep contractions often give way to shallower contractions before something of zero-growth stability is reached that, in turn, can predict a new period of relatively positive growth. It remains clear, however, that U.S. manufacturing fortunes are going to be mostly tied to innovation-intensive durable goods industries, many of which are benefitting from structural and process changes throughout the manufacturing sector, both in the U.S. and abroad. Innovation-intensive industries, by the standard metrics of R&D and patents, include the machinery and aerospace subsectors. Innovative activity in these subsectors has positive spillover effects that help with productivity and growth in other subsectors by allowing critical production inputs to be cheaper, better, and faster.

Encouraging Subsectors:

- Our forecast for the aerospace subsector has strengthened. We currently project a 5.6% average growth rate between 2018 and 2021, a marked acceleration from the 3.8% average growth rate that we projected in our November 2017 report. A more robust global economy and strong air travel demand are propelling this subsector, which has been a lynchpin of U.S. manufacturing global competitiveness. After six years of contraction, inflation-adjusted U.S. federal government expenditures on defense spending experienced a modest rise in 2017. If this persists, it will stimulate the national security section of the aerospace market and thus create an even stronger outlook.

- The computer and electronic products subsector and the machinery subsector are benefitting from the recent capital spending rebound that is partially catalyzed by a much-improved economic growth outlook. The annual growth of the computer and electronic products subsector is expected to average 4.8% between 2018 and 2021, while machinery subsector average growth is expected to be a modestly slower 4.3%. The forecast for both subsectors is markedly above our November 2017 forecast of 2.5% average growth for machinery and 2.6% average growth for computers and electronic products. Differential growth rates between computers and machinery come from servicing different markets. The computer industry sells to both the business and consumer market, while, except HVAC, the machinery subsector sells primarily to the business market.

- The chemicals subsector continues to be a strong performer. The MAPI Foundation currently anticipates 3.8% average annual growth between 2018 and 2021, solidly above the 2.6% average that we projected in our November 2017 report. Cyclical strength in housing and demographic forces underpinning the demand for pharmaceuticals are among the tailwinds for chemicals output growth.

Source: MAPI Foundation

Outlook Perspective: Consumer, Investment, and Materials-Related Industries

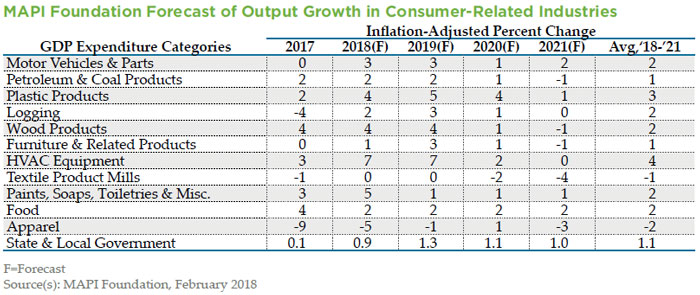

Except the structurally-challenged apparel industry, consumer goods output is projected to be stable to strong during 2018 and 2019. With average growth rates of 7% and 4% respectively, HVAC Equipment and Wood Products have notably strong growth outlooks for 2018 and 2019, spurred by an ongoing housing recovery that is supported by a strong job market that finally appears to be generating modest wage gains. The slower 2020 and 2021 forecasts, with wood products output projected to be flat and HVAC projected to be a sluggish 1%, reflect the cyclically expected slowing in the housing market that will be partially catalyzed by rising mortgage interest rates.

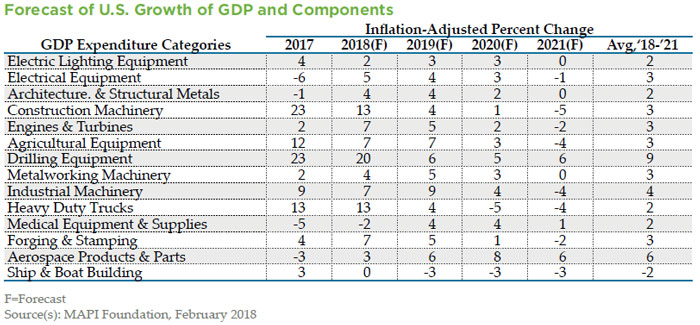

The anticipated strength in the growth of key investment-related industries during 2018 and 2019, such as industrial machinery, metalworking machinery and construction machinery, reflects the overall improvement in business equipment investment. Driven by a projection of accelerating growth in the manufacturing sector, growth in the industrial machinery subsector is projected to be a strong 8% average for 2018 and 2019. Metalworking machinery growth is expected to be 4% in 2018 and 5% in 2019. Buttressed by the expected steadiness in oil prices, drilling equipment output growth is expected to average a strong 9% between 2018 and 2021.

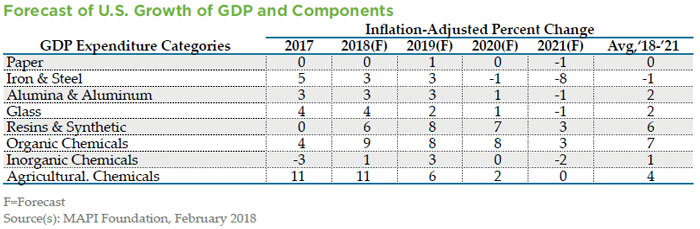

he renewed buoyancy in the global economic picture is reflected in our projections of moderate to strong output gains in most materials industries for 2018 and 2019. Resins and Synthetics, as well as Organic Chemicals, have notably strong outlooks, projected to have average growth rates of 6% and 7% respectively between 2018 and 2021. We expect a slowing and in some cases a contracting, in the output growth of many materials industries after 2019 concomitant with our projection of moderation in global growth during 2020 and 2021.

Summary

Aerospace, machinery, computers and electronic products, and chemicals are catalyzing a dramatic improvement in the overall U.S. manufacturing growth picture, as the sector appears poised for its strongest output growth performance in more than a decade. A wide range of consumer-related, investment-related and materials industries are expected to see moderate to strong output growth during 2018 and 2019, before slowing during 2020 and 2021. Full details of the Foundation’s U.S. economic growth forecast are available in Marked Strengthening in the U.S. Manufacturing Outlook